Foreigners living in Spain must determine whether inheritance tax in Spain applies to them. In 2015 the European Union (EU) introduced regulations enabling EU citizens (and some non-EU countries’ citizens) living in Spain to nominate their home laws or Spanish laws to apply to their estate. Whichever jurisdiction is nominated will apply to the whole estate regardless of the location of assets.

Foreigners living in Spain must determine whether inheritance tax in Spain applies to them. In 2015 the European Union (EU) introduced regulations enabling EU citizens (and some non-EU countries’ citizens) living in Spain to nominate their home laws or Spanish laws to apply to their estate. Whichever jurisdiction is nominated will apply to the whole estate regardless of the location of assets.

If a foreign resident dies without a will or declaring their chosen jurisdiction, then the laws of the country the person was living in for the past five years apply. Although there is no requirement to make a Spanish will, expiates in Spain should register a will or declare their chosen jurisdiction.

Spanish inheritance regime

Spain has a civil law system, so beneficiaries pay inheritance tax. Whereas, in common law countries (e.g. UK and US), the estate is taxed prior to being distributed to beneficiaries. In Spain, inheritance law is regulated at a national level via the Spanish Civil Code. Some autonomous communities have additional regional regulations. To pay inheritance tax in Spain, foreigners must obtain a tax identification number (NIE).

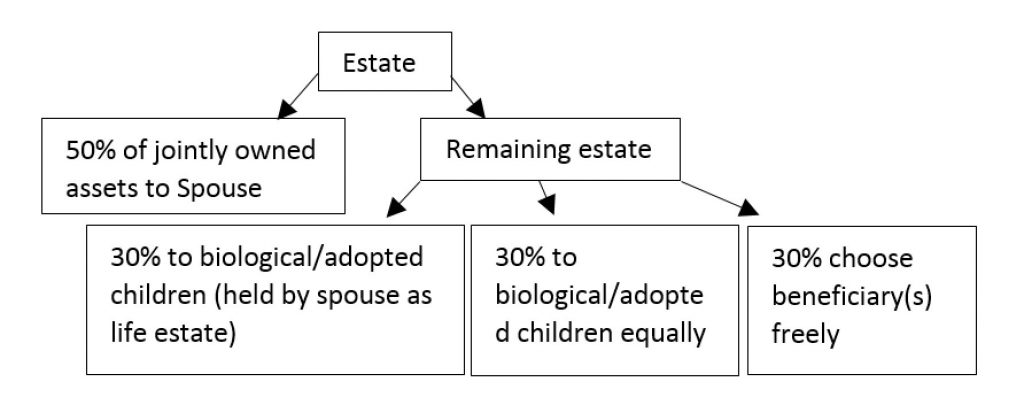

Spain’s inheritance law includes “forced hardship” (also known as the “law of obligatory heirs”), meaning a certain percentage of an estate must be set aside for spouses, children, and parents. For example, an individual with a spouse and children has their estate distributed as follows:

If most of an individual’s assets are in Spain, but they nominated another jurisdiction, their relatives may contest the will claiming the individual avoided forced heirship to disinherit them.

If an individual has no will and Spanish law applies, then the estate is distributed, according to forced heirship with the remainder given to the children. If there are no children, then it is given to the parents and if there are no parents it goes to the spouse. If there are no parents, children or Spouse, then the remainder goes to the next of kin.

Tax rates and allowances – inheritance tax in Spain

Tax rates vary according to the relationship between the donor and beneficiary. For example, generally, defacto partners pay higher tax rates than spouses and step-children pay higher tax rates than biological or adopted children. There are also higher allowances for certain relatives. For example, the national laws provide spouses with an allowance of approximately €15,957 with no allowance for defacto partners. Some autonomous communities have higher tax allowances for defacto partners.

Inheritance tax in Spain and in general inheritance law is important for foreigners living in Spain to understand. We hope this guide is helpful, please do not hesitate to contact our office for further information.

Víctor Sáez